Mortgages To Fit Your Life Plan

Professional advice for working professionals

So you can live your best life with a strategy to achieve your real estate and financial goals

Feel Empowered

Get the advice, strategy, and mortgage to achieve your lifestyle goals.

Save Time and Money

Achieve long term savings beyond just rate.

Experience our personalized and technology driven process designed to be efficient and convenient for you.

Create Wealth

Take advantage of opportunities to enhance your financial future with real estate investing.

Getting a mortgage on your own with a traditional bank can COST you!

Frustration

with paying more overall costs for your mortgage beyond rate

Overwhelmed

with spending excessive time researching for options

Struggle

with making the right decision without a mortgage professional whose interest is aligned with you

Miss out

on options and expertise that the banks do not offer

We believe you deserve

You deserve a mortgage that works for you. Finding and financing your home is a huge investment in time and money. For most, it is the biggest financial investment they’d ever make in their lifetime.

Therefore, your mortgage should fit into your overall financial strategy. Unfortunately, the mortgage industry isn’t set up that way. Most banks and mortgage providers are very transactional, and rate focused. We want to provide you with much more to ensure you are empowered in the process, get clarity on where you are going and be confident that your mortgage fits into your overall financial life plan.

Let us be your strategic mortgage partners

Matt still remembers clearly when he bought his first home. At the time, he was still raising a very young family and just started his new mortgage career. The prospect of buying his first home was overwhelming and downright terrifying.

Matt also remembered the feeling when he bought his first investment property. There was a lot of anxiety he had no idea what it meant to be a landlord, whether or not it was the right decision and time to buy and even if it was affordable.

Because of this experience and his love of real estate, Matt is dedicated to supporting others to achieve their dream of home ownership. Whether you are buying your first home or aspire to build a real estate empire, Matt is committed to providing a sound strategy to achieve your goals.

After starting his career as a professional accountant and achieving his CPA (CA) designation in Vancouver, Matthew moved to Toronto to pursue an MBA from the Rotman School of Management at University of Toronto. In 2004, Matthew moved back to Vancouver to raise his family and start his mortgage career.

Since starting his career, Matthew has served as a board member for the Canadian Mortgage Broker Association of BC and achieved Elite Hall of Fame status with Dominion Lending Centres. Matthew is also an avid Real Estate Investor and loves to share his knowledge and passion of real estate investing with others.

With his professional qualifications, educational background, industry experience as both a mortgage professional and as a real estate investor, Matthew has the skillset to advise you on your mortgage and real estate goals.

When not in his office, Matthew enjoys spending time with family and friends, training Gracie Jiu Jitsu and pursuing personal and professional development.

Here are some nice things clients say about working with us

Let us help you find a mortgage that best fits your life plan

Budget

Proposal

We review both the costs to complete and the regular recurring costs of home ownership with you so you feel secure and confident to move forward every step of the way.

Mortgage

Options

We listen to you and provide advice and financial education. With access to multiple lenders and products, we can review and present options that fit with your plan.

Support You Throughout the Process

We keep you regularly updated from the start to completion. Once you complete, we continue with regular updates to ensure we are still moving towards your goals.

We'll guide you to a solution with these 3 simple steps

Schedule A

Discovery Call

We get to know each other a bit better and learn more about what your short term and long term real estate and financial goals are. We get a high level view of what your options could look like.

Build a Custom Mortgage Proposal and Review Strategy with You

After we review your application in more depth, we propose options and help you evaluate the pros and cons of each, You get more clarity on your strategy for your long term goals.

We Implement

The Plan

With more insight, you choose the option that best fits your life. We handle the rest. You feel confident and empowered knowing you made a great decision.

Everything you need, all in one place.

As trusted mortgage providers, we can help you with these services.

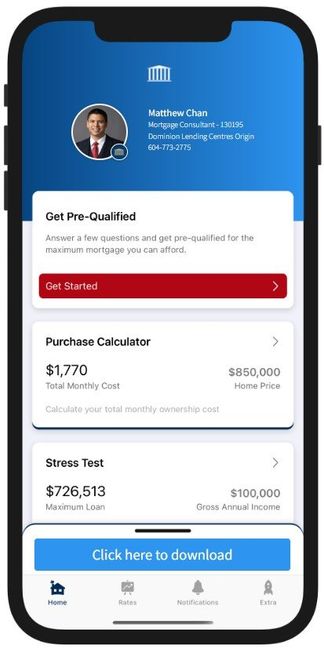

Download

My Mortgage Toolbox

using my personal install buttons below so you can get exclusive access to all premium features.

WHAT CAN YOU DO WITH MY APP:

- Calculate your total cost of owning a home

- Estimate the minimum down payment you need

- Calculate Land transfer taxes and the available rebates

- Calculate the maximum loan you can borrow

- Stress test your mortgage

- Estimate your Closing costs

- Compare your options side by side

- Search for the best mortgage rates

- Email Summary reports (PDF)

- Use my app in English, French, Spanish, Hindi and Chinese

ARTICLES